Microelectronic Solutions has been the Australian channel partner of ARCA Cash Recycling solutions since 2004 and has successfully implemented their suite of cash automation banking solutions nationally in several Major Australian banks.

We specialise in integrating the most advanced technologies into your retail branches to provide significant time and cost savings. Our goal is to return valuable time to your branch staff to enable more focus on customers.

Create Efficiency

Cash recyclers within the branch create a tremendous opportunity to simplify staff cash handling accurately.

For branches experiencing declining cash usage, they can reduce the need for bulk cash vaults in the back office.

Branches that use cash recyclers experience significant time saving advantages by eliminating the time spent counting customer cash and recounting and reconciling back-office cash vaults.

It is well known that by installing cash recyclers in retail branches, you’re able to service more customers and reduce teller queues.

Create Opportunity

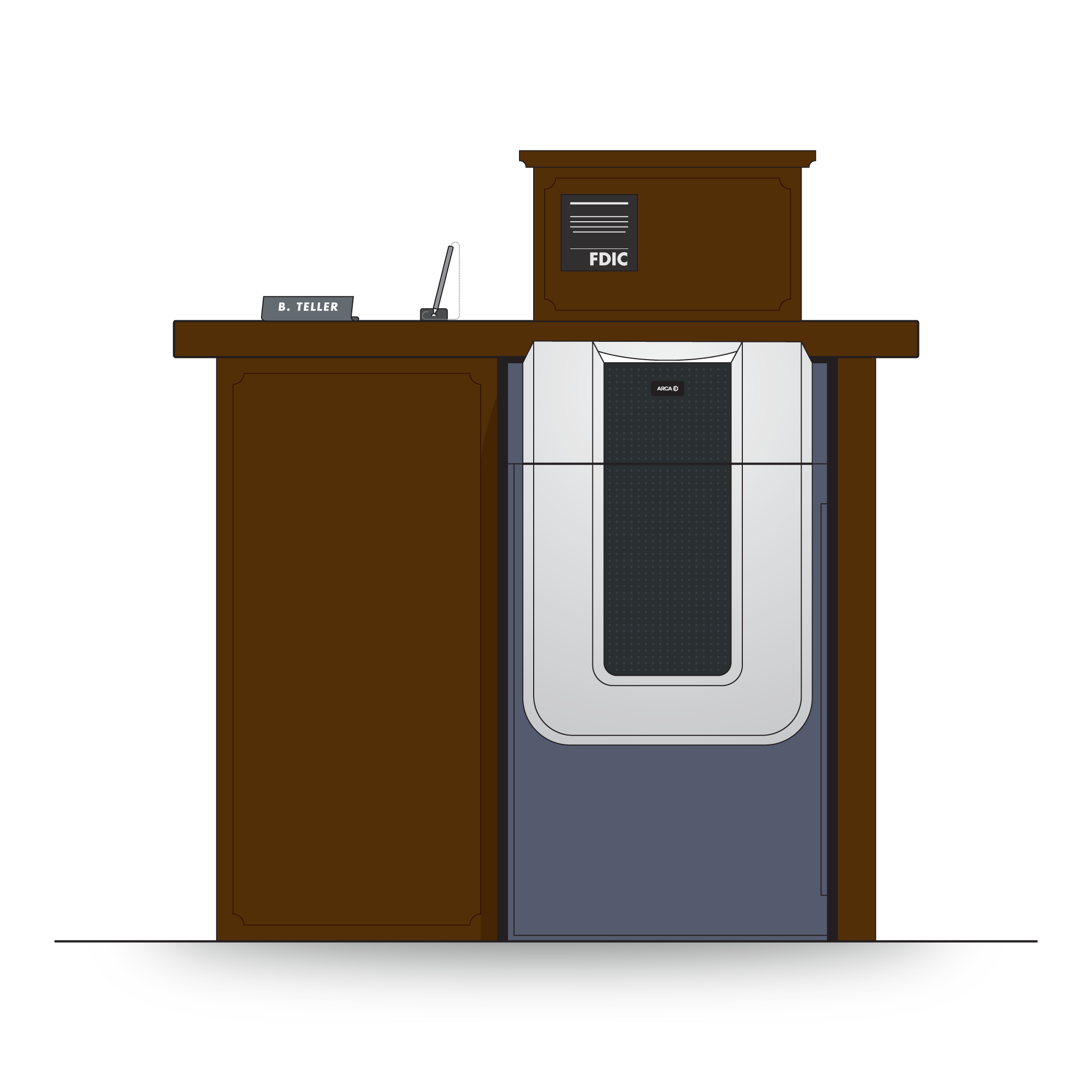

With cash recyclers, teller counters can be remodelled to create more open plan environments, where you can better engage with customers.

Tellers and customers can transact with a higher level of security as the front counter cash is held securely within the cash recycler’s vault.

Staff can be better placed to work alongside customers to strengthen relationships and boost referrals for products to meet their needs.

Create a better customer experience with a more tailored and personalised service to showcase the bank’s marketing messages.

Branch transformation initiatives are often considered a daunting task for financial institutions. Some banks that have made this transition experience up to a 50% increase in branch revenue per square metre, 25% increase in customer acquisition and a 35% increase in customer meetings. These early indicators present solid bank performance metrics that can be replicated by your bank.

Assisted Self-Service Kiosk

Self service with a human touch

EVO180T Assisted Self-Service kiosk, based on the ARCA R3000 T teller cash recycler, is a versatile in-branch system that can be used as a stand-alone customer-facing solution or as a partly-assisted self-service technology in conjunction with a teller.

This pliability allows branches to tailor the technology to fit their individual needs in a very compact footprint. The EVO180T Kiosk can be configured to operate as an attended ATM via your switch or as a branch device utilising your core banking system. Being modular by design, you can nominate which components each Assisted Self-Banking terminal requires for your branch, depending on what in-branch services you want to offer to your customers.

By using our modular, customisable Self-Service kiosk, transactions can be relocated to a lower cost self-service channel, thus freeing branch staff to build or develop customer relationships and allowing them to focus on generating revenue for the bank.

Proven, reliable performance

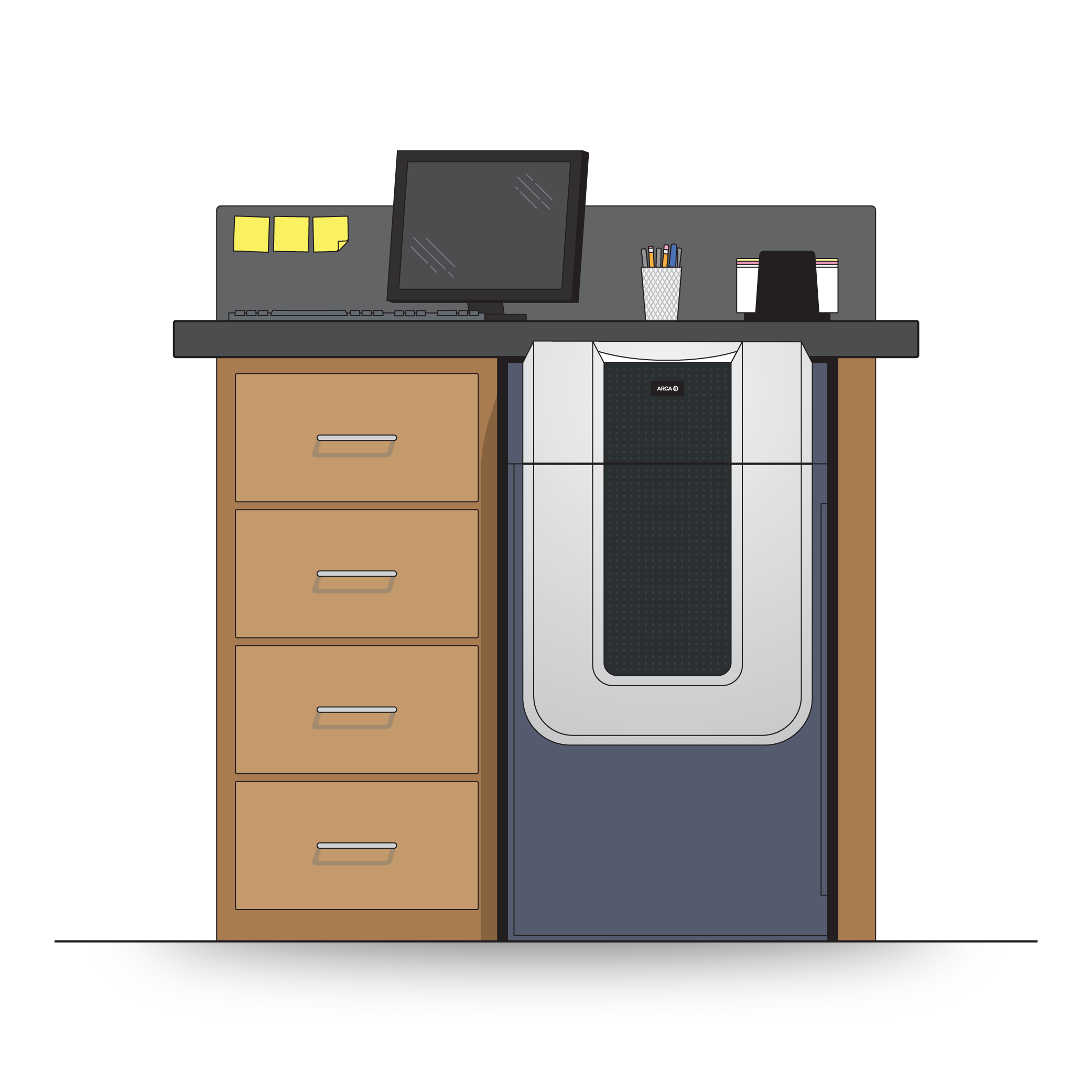

ARCA R2000 S Teller Cash Recycler

The most deployed cash recycling platform in the world.

Quite possibly the most reliable cash recycler ever built, the ARCA R2000 S is a versatile device that integrates seamlessly into any modern cash teller environment. It performs the counting, depositing and dispensing of banknotes in the simplest and most straightforward of manners, while increasing security at the teller position.

The ARCA R2000 S comes in two iterations – the ARCA R2000 S fits seamlessly under any standard desk, while the ARCA R2000 T is designed for under-the-counter and standing environments while maintaining the same reduced footprint. Additionally the ARCA R2000 T offers a scalable capacity that can grow from 8 to 12 recycling modules at any time.

Fixing the back-office cash problem

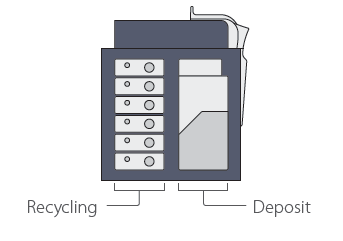

ARCA R2200 Cash Recycler & Deposit

The dual-function cash recycler

The ARCA R2200 is a cash recycling machine with an extended deposit capability that provides benefits to retailers, commercial banks, and cash-in-transit (CiT) companies.

The ARCA R2200 makes manual cash management a thing of the past. It eliminates labour-intensive, cash-related tasks from management’s responsibilities. By automating traditional manual cash handling processes you will realise lower labour costs while freeing employees to focus on what matters most — the customer.

We supply ARCA R2200 with either a software application or a customisable platform to integrate and complement your business operation.

Evolution of the species

ARCA R3000 Cash Recycler

Intelligent and elegant

The ARCA R3000 is built upon the same ARCA R2000 platform banks and credit unions have relied on for years.

With a completely revolutionary design and sleek user interface, the ARCA R3000 bridges the gap between teller- and consumer-led transactions. Adaptable components give the Evo extraordinary versatility for use as either a teller or customer tool.

The ARCA R3000 dynamically changes the perception of a traditional cash recycler. With a customer-friendly interface and advanced security features, this technology can be transitioned from behind the teller line to an assisted self-service branch model.

Finally, a single product gives your tellers the power of cash recycling then lets you decide when you (and your customers) are ready to put the power of cash automation in their hands.

Benefits of Cash Automation

Increase revenue and lower cost

Employees are freed to develop relationships and offer new services to customers and eliminate wasted time and effort counting and corralling cash.

Save time

Automating deposit, validation, denominational sorting, counting, storage and dispensing cash saves tellers as much as 90 minutes a day.

Use cash more efficiently

Recyclers allow you to operate efficiently with less cash-on-hand in each branch, maximize note recirculation and reducing cash-in-transit costs.

Save money

Recyclers are rated for overnight cash storage. With no need to clear cash daily, you can reduce labor and cash-in-transit costs.

Increase safety

Cash automation lowers the amount of cash in the branch environment, reducing risk and increasing the odds a robber would choose a different target.

Increase customer satisfaction

Assisted self-service terminals allow customers to complete their transactions on their own and call for a teller if they need assistance.